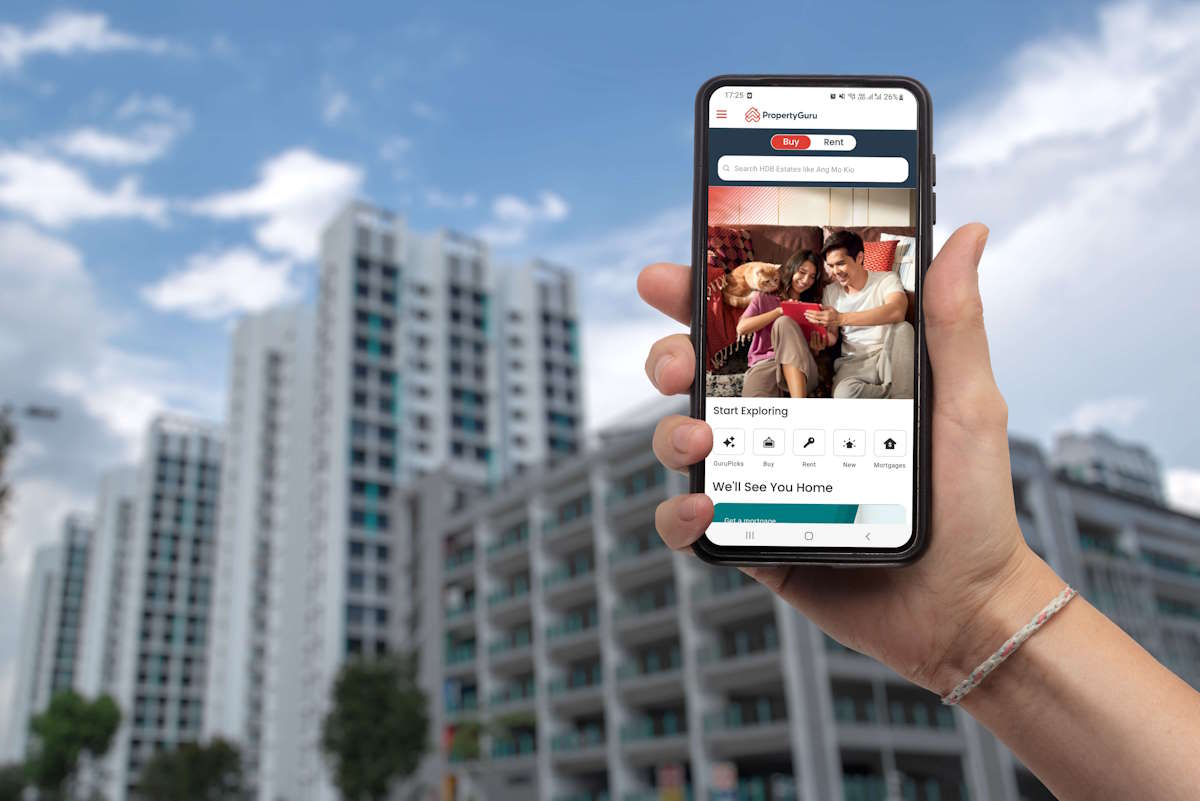

SINGAPORE, 12 March 2020 – PropertyGuru, Singapore’s number one property technology company with over 75% market share*, today announced its expansion into home finance. With the launch of its mortgage marketplace, ‘PropertyGuru Finance’, PropertyGuru aims to help Singaporeans save money and experience a smoother journey in financing their home. PropertyGuru Finance will offer the best mortgage rates, digital tools that will help property buyers make smart financing decisions, and independent, personalised advisory for better long-term benefits.

While Singapore is one of the most property savvy markets in Southeast Asia, the ‘PropertyGuru Consumer Sentiment Study H1 2020’ highlights that while 70 percent of Singaporeans will ‘start saving before looking for a home to buy’, only 18 percent are ‘very familiar with the home loan process’. The complexity of the mortgage process is further reflected in the knowledge gaps revealed in the study:

- Almost 50% of home buyers are not familiar with the paperwork that is required to apply for a home loan

- 2 in 5 Singaporeans are not aware that they can refinance their home loan and save on monthly costs, more so among lower income groups

- 30% of home buyers believe that online tools such as an Affordability Calculator would assist, but admit that they have never actually used one.

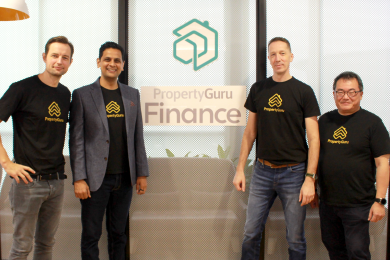

Announcing the launch, Bjorn Sprengers, Chief Marketing Officer and Head of Fintech, said, “Over the years, we have learnt that the excitement of finding one’s dream home, is often lost when it comes to financing it. The mortgage journey is full of uncertainty, doubt and inefficiency. More often than not, the process leads people to paying more than they should. Its complexity may even cost them the opportunity to own their dream home. As market leaders, we have a responsibility to help resolve these pain-points and much like PropertyGuru helped Singaporeans find their homes online, we now use technology to improve the process of how people will finance their homes.’’

PropertyGuru’s entry into home finance is a key milestone in the company’s strategic evolution from a property marketplace to becoming a ‘trust platform’ in Southeast Asia. Bjorn Sprengers adds, “The launch of the mortgage marketplace takes the company beyond its focus of ‘property search’ into ‘Find.Finance.Own’. Our vision is to integrate property search and financing into a seamless digitally intuitive experience for property seekers. This vision encompasses PropertyGuru’s own platform and solutions as well as the broader ecosystem including banks, regulators and other stakeholders. Our aspiration is to enable Singapore’s first digital straight-through mortgage application by 2022 and the first fully digital property transaction by 2025.’’

Working with relevant industry stakeholders, the company will offer digital home financing services such as instant in-principle approval, instant offers, refinance checks, to enable property buyers to consume home financing services conveniently, securely and instantly online.

As Singapore’s preferred property marketplace for over thirteen years, PropertyGuru is uniquely positioned to help home loan seekers save money. Paul Wee, Managing Director of Fintech, explains, “As Singapore’s largest property marketplace, we have access to the best rates offered by banks. Because we are independent from these financial institutions, we can offer unbiased, personalised, in-person advice during and after office opening hours. Our loan advisors collectively have more than 100 years of experience.’’

He adds, “PropertyGuru’s technology allows us to uniquely offer a range of smart tools for every step of the home finance journey, from understanding loan eligibility and comparing loans to easily applying for multiple loans online. We use PropertyGuru’s proprietary data to constantly monitor home valuations and interest rates to help property owners optimally time moments of refinance and enjoy full benefit from capital gains.’’

With PropertyGuru Finance, the company extends its partnership with its clients (real estate agents). PropertyGuru will act as an agent’s ‘personal mortgage assistant’ enabling them to offer their clients (property seekers) convenient access to all best available properties and home finance options under a single roof.

*Source: SimilarWeb, Consumer Market Share, August 2019 – Jan 2020

About PropertyGuru Group

PropertyGuru Group is Asia’s leading property technology company and the preferred destination for over 20 million property seekers to find their dream home, every month. PropertyGuru and its group companies empower property seekers with the widest option of more than 2 million homes, in-depth insights and solutions that enable them to make confident property decision across Singapore, Malaysia, Thailand, Indonesia and Vietnam.

PropertyGuru.com.sg was launched in 2007 and revolutionised the Singapore property market by taking it online and made property search transparent for the property seeker. Over the decade, the Group has grown from a regional property media powerhouse to a high-growth technology company with a robust portfolio of No.1 property portals across its core markets; award-winning mobile apps; best-in-class developer sales enablement platform, FastKey; and a host of industry-leading property offerings including Awards, events and publications across Asia.

For more information, please visit www.PropertyGuruGroup.com ; https://www.linkedin.com/company/propertyguru

For further queries or media interviews, please contact: