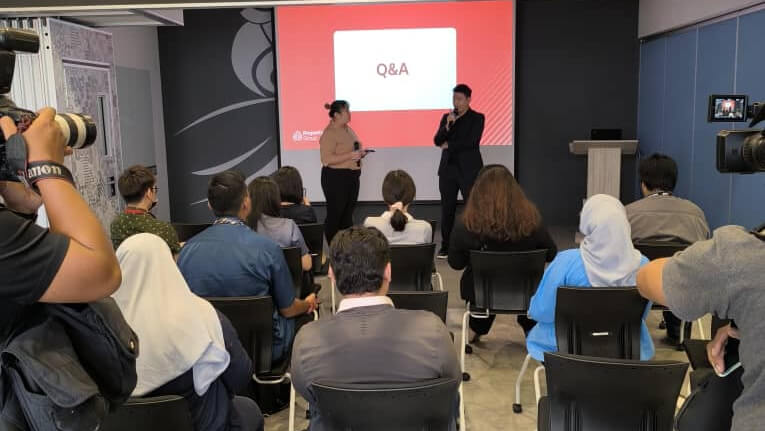

KUALA LUMPUR, 2 OCTOBER 2024 — PropertyGuru Malaysia unveiled key insights from its latest H2 2024 Consumer Sentiment Study during the Malaysia Property Pulse Check event. The study highlights the affordability challenges faced by homebuyers and renters, and the growing demand for sustainable urban development.

As Malaysia’s housing market faces rising costs and evolving economic conditions, PropertyGuru’s findings empower consumers with actionable data to explore homeownership and rental options, particularly in emerging areas beyond the central districts. Additionally, developers and agents can leverage these insights to align their residential projects or engagement strategies with shifting demand and consumer preferences. These data are important as Malaysians continue to navigate economic pressures in today’s market.

Navigating Economic Pressures in the Housing Market

The H2 2024 Consumer Sentiment Study spotlights the substantial challenges that the Malaysian housing market is facing. 40% of first-time buyers expressed difficulty in saving for down payments, pointing to the broader impact of inflation, high living costs, and rising interest rates on Malaysians’ ability to achieve homeownership. This issue is further compounded by 40% of respondents idetifying high interest rates as a major obstacle, making it harder for buyers to manage their monthly mortgage payments.

Government Support and the MADANI Deposit Initiative

The study revealed that 50% of respondents desire greater government support in the form of affordable housing schemes, financial subsidies, and policies aimed at reducing the financial burden of homeownership. The proposed MADANI deposit initiative by the Housing and Local Government Ministry (KPKT) has the potential to ease the upfront cost of homeownership by reducing deposit requirements for first-time buyers. This initiative aims to make property ownership more accessible, especially for younger Malaysians working towards financial stability.

The initiative also opens opportunities for more Malaysians to consider purchasing homes in emerging areas where property prices may be lower but still offer excellent connectivity and amenities.

Rental Market Challenges: Financial Strain and Rent Control

The rental market also presents its own set of challenges. The study shows that 53% of renters struggle with the upfron deposit system, which requires tenants to pay two months’ rent as a deposit and an additional month in advance. This high initial outlay places a significant burden on renters, particularly those with lower incomes or younger tenants just entering the workforce, which cause more renters to delay or reconsider their housing options.

Moreover, 44% of renters reported difficulties in negotiating fair rental prices, especially in high-demand urban areas like Kuala Lumpur. The lack of standardised rental guidelines has led to inconsistencies in rental pricing, which leaves tenants at a disadvantage. Renters and landlords are increasingly calling for rent control mechanisms, with over 50% of both groups advocating for regulation to stabilise rental prices and create a more predictable market.

Opportunities in Emerging Areas: Kepong and Sungai Besi Lead the Way

Despite the challenges, certain areas in Malaysia are seeing a year-on-year surge in demand, reflecting the shifting preferences of younger homebuyers and renters. According to PropertyGuru Malaysia’s demand index, Kepong saw a 31.3% increase in demand for serviced apartments, driven by its affordability, strategic location, and proximity to amenities. As Klang Valley continues to develop, Kepong has emerged as a promising area for property investment, appealing particularly to young professionals and first-time homebuyers.

Sungai Besi also experienced a 32.7% increase in demand for serviced apartments. The areas appeal stems from its connectivity to Kuala Lumpur City Centre and neighbouring areas like Cheras, Kajang, and Bukit Jalil. The development of infrastructure in these areas has triggered a ripple effect, driving increased demand for residential properties as residents seek affordable alternatives to city-centre living while maintaining accessibility to lifestyle amenities and facilities. This growing interest in emerging areas reflects a broader trend towards sustainable, well-connected living environments, with buyers increasingly exploring locations that offer a balanced mix of affordability and modern conveniences beyond traditional urban centres.

Sustainability and the Future of Urban Living

Sustainability has become a key factor for Malaysian homebuyers, with 7% of respondents citing climate impact as an important consideration when making property decisions. As the country moves towards greener developments, there is increased demand for properties equipped with eco-friendly features such as solar panels, energy-efficient appliances, and smart home technologies. Additionally, green commuting options like cycling paths and proximity to public transportation are becoming highly desirable.

The concept of 15-minute cities and townships, where residents can access essential services such as healthcare, education, and retail within a short commute, is gaining traction. Such developments are reflective of a larger shift towards integrated, self-sustaining communities that prioritise environmental responsibility alongside economic growth.

Kenneth Soh, Country Manager – Malaysia, PropertyGuru and iProperty said, “Homeownership remains a key priority for many Malaysians. According to the H1 2024 edition of the Consumer Sentiment Study, 1 in 3 respondents intend to purcase a property within the next two years. To support this, it is crucial for home seekers, agents and developers to have access to accurate data and actionable insights. As Malaysia continues to track economic interest and development, PropertyGuru hopes to bridge the gap between buyers’ expectations, agents’ propositions and

developers’ offerings with relevant Proptech data and solutions; to foster a more balanced and sustainable property market.”

###

About PropertyGuru Malaysia

PropertyGuru.com.my is Malaysia’s leading property marketplace and has been guiding Malaysians in navigating their home-ownership journey since 2011. The company provides easy-to-use, property market data and actionable insights such as Property Guides, Property Market Reports and Home Loan Calculator, which enable property seekers to make confident property decisions wherever they are in their property journey. PropertyGuru Malaysia offers end-to-end solutions for Malaysian property agents (AgentNet) and developers to help achieve their business goals. These include a host of proprietary enterprise solutions under PropertyGuru For Business including DataSense, ValueNet, Awards, events and publications across Asia.

The company is part of PropertyGuru Group, Southeast Asia’s leading property technology company.

Media Contacts:

Ng Keng Wee

Head of Corporate Communications, PropertyGuru Group

Ariff Communications

Aizat Hazwan / Hanum Afandi